The Powell Memo Revisited

by Brad Wolf

Justice, it seems, is hard to find. Thousands of grassroots organizations across the country seek justice for their concerns. In the US, over 13,785 nonprofits work for civil rights and social justice. Organizations focused on international justice such as peace, refugees, and international aid number 23,532. Environmental groups number 27,402.

Until corporate monoliths are disassembled and defanged, justice will be hard to find.

From peace to prison, the environment to economic inequality, many Americans fight for their cause, plead for justice. The dynamic is similar in other countries.

Who, or what, are the forces behind so much injustice and suffering? Is there a common culprit, a common thread or threat?

In 1971, Lewis Powell, soon to be placed on the Supreme Court by Richard Nixon, was a high-powered corporate lawyer sitting on the boards of almost a dozen corporations when he penned the Powell Memo, a letter directed to the Director of the US Chamber of Commerce. Powell expressed his grave concern that American business and free enterprise were under full-scale attack from "leftists" and might altogether collapse unless drastic steps were taken.

Powell identified academia, the news media, television, artists, preachers, teachers, Ralph Nader specifically, and certain politicians as being the most articulate and attractive purveyors of this "chorus of criticism" designed to bring down all of American business. Action must be taken, and now.

Citizens were challenging big business, holding them accountable, demanding governmental oversight, exercising their democratic rights. To Powell, the corporate lawyer and perennial corporate board member, this was a bridge too far. The chorus must be killed, power returned to the kings.

The future Supreme Court Justice went on to outline in detail how the corporate world must retake control and influence over every aspect of American life.

Academia must be seeded with professors sympathetic to big business, textbooks reviewed and evaluated, guest speakers deployed on campuses to counter the narrative. Powell wrote that corporations provide lucrative contracts and benefits to colleges and universities, and these should be used to influence precisely what occurs on a college campus.

Powell made a similar argument about the media. News organizations are owned by corporations, and they too must be persuaded to realize that their corporate profits hang in the balance if they continue to publish stories unfavorable to American business. Stories about consumer rights and environmental rights must stop. The same for television, a medium Powell highlighted as perhaps the most effective source of information, or disinformation.

The political arena must not be neglected, said Powell, because "political power is necessary; such power must be assiduously cultivated; and when necessary, it must be used aggressively and with determination—without embarrassment and without the reluctance which has been so characteristic of American business." In other words, no holds barred. Lean on public servants in a way they have never experienced.

Paid advertisements, the courts, stockholders, lobbyists, writers, think tanks, and the Chamber of Commerce itself with its hundreds of chapters across the country must all be utilized, weaponized in this war against the chorus of critics.

To read the Powell Memo today is deeply disturbing, not just because it was written by a future Supreme Court Justice who was advocating a corporate takeover of American democracy, but also because the actions detailed were so successfully deployed and completed. Powell was prescient. His plan worked. And the average American pays the heavy price today.

In the United States, power no longer lies within the halls of Congress or the White House, but within the corporate temples.

Our foreign policy, our diplomacy, our war-fighting strategy, are all influenced and dependent upon corporate weapons manufacturers with their legions of lobbyists depositing $285 million into the campaign war chests of candidates across the country, spending a total of $2.5 billion in lobbying over the last twenty years. The US Supreme Court opened the doors to such unlimited corporate campaign spending in its Citizens United decision.

Fossil fuel companies turn up the heat on all of humanity such that we literally boil from climate catastrophe, all so they can rake in record profits. Working hand in glove with weapons manufactures and the media, they foster war and generate enormous revenue for each, using lawyers and lobbyists to implement their cancerous policies.

Many colleges no longer teach or even believe in a broad-based liberal arts education, but rather are technical training schools for investment banks, marketing firms, law firms, accounting firms, weapons manufacturers, and conservative or military think tanks. With the funding of buildings, research grants, and faculty chairs, the corporate takeover of our intellectual life is virtually complete. Students travel through four years of college without a course in American government, history, or literature, resulting in a woefully uninformed electorate.

Prisons are privatized and corporatized thereby influencing criminal justice reform. Schools are privatized and corporatized thereby influencing the development of young minds. Our media, and more importantly now, our social media, is owned by corporate oligarchs who influence the narrative fed to us each day, a narrative designed to keep people scared and pitted against each other.

Thanks to Powell and his colleagues, the planet now faces multiple crises, and perhaps extinction, by way of corporate hand. The danger is real, existential, measurable. The dead can be counted. The homeless, the hungry, the drought stricken, and the war-ravaged form a chorus of suffering. Corporate profits, CEO salaries, lobbying expenditures, and tax cuts reveal the why and how.

ExxonMobil, Shell, Raytheon, Lockheed Martin, Vanguard, Blackrock, Northrop Grumman, CoreCivic, and all their kin have staged a hostile takeover of government and the daily life of its people. They hold the reigns. They are the common thread and threat. Until corporate monoliths are disassembled and defanged, justice will be hard to find.

https://www.commondreams.org/views/2022/12/08/powell-memo-revisited

Next-gen health care reform

by Merrill Goozner, gooznews.substack.com - November 22, 2022

Given the Democratic control of the Senate and a narrow GOP majority in the House, major initiatives in health care policy will be off the table in the next Congress. But with Sen. Bernie Sanders (I-VT) in line to run the upper chamber’s Health, Education, Labor and Pensions (HELP) committee, reformers on Capitol Hill have an opportunity to educate the public about what next-gen health care reform should look like.

Rather than use his committee’s time to continue tilting at the windmill of a single payer system (which draws hostile opposition from insurers, employers, most union-run plans, and many providers), he should hold hearings on a series of payment reforms that would achieve many of the same goals.

In thinking about what those reforms should be, my own thinking is guided by two principles. First, they should move the system toward achieving what health care policy wonks call the triple aim: universal access; higher quality with better outcomes; and lower costs for patients and payers. And, they should be politically feasible, i.e., have the potential to put together winning coalitions.

Over the next several weeks, I will lay out such an agenda. It has three essential components, each of which can be pursued on its own with immediate benefits for the system. They are:

Replace the 50 state Medicaid programs with a unified federal program that offers states tax relief and its beneficiaries (now one in four Americans) better care;

Equalize provider prices for all payers to eliminate administrative waste and the gross disparity between what public and private payers spend on individual services; and

Move hospitals and physician practices onto annual budgets under the control of organizations that can take full responsibility for their patients’ total cost of care.

Today, I’ll start with Medicaid. Prior to this month’s election, I feared a GOP-controlled Congress would use its predicted majority to advance the most radical plank in its health care agenda: funding Medicaid with block grants to the states. Thank goodness the pundits and pollsters had it wrong.

The trial balloons issued by some Republicans to cut Medicare benefits and promote further privatization – the issues highlighted by Democrats on the campaign trail – posed much less of a threat in my mind. Many if not most members of the GOP will run away from cutting seniors health benefits in the name of fiscal austerity in the two years leading up to a high turnout presidential election.

But cutting benefits for the poor? That’s something the entire GOP has united around before and will again. The sad reality is that defending the poor has much less salience with the voting public than defending seniors.

Block grants would be a disaster for a program that now provides health insurance for 83 million souls and covers 42% of all births. It would give Republican-controlled states the leeway to further reduce their already skimpy coverage. It would set back efforts in the 11 states that still haven’t expanded Medicaid to cover people earning up to 138% of the poverty line. And block grants would become the vehicle for ratcheting down federal support over time, which would make it politically difficult for more generous states to maintain their existing programs since it would entail raising state and local taxes.

Medicaid expansion was crucial to the Affordable Care Act’s cutting the U.S. uninsured rate in half over the past decade. But there are still 8% of Americans without health insurance.

As we saw from South Dakota’s vote in favor of Medicaid expansion, the public in conservative areas is slowly coming around to seeing the wisdom in helping the working poor. Getting all states to expand Medicaid would go a long way toward reducing the coverage gap. When that is coupled by a friendly Congress with more generous subsidies for individual and family plans sold on the exchanges, the U.S. will be able to finally get its uninsured rate down to negligible levels.

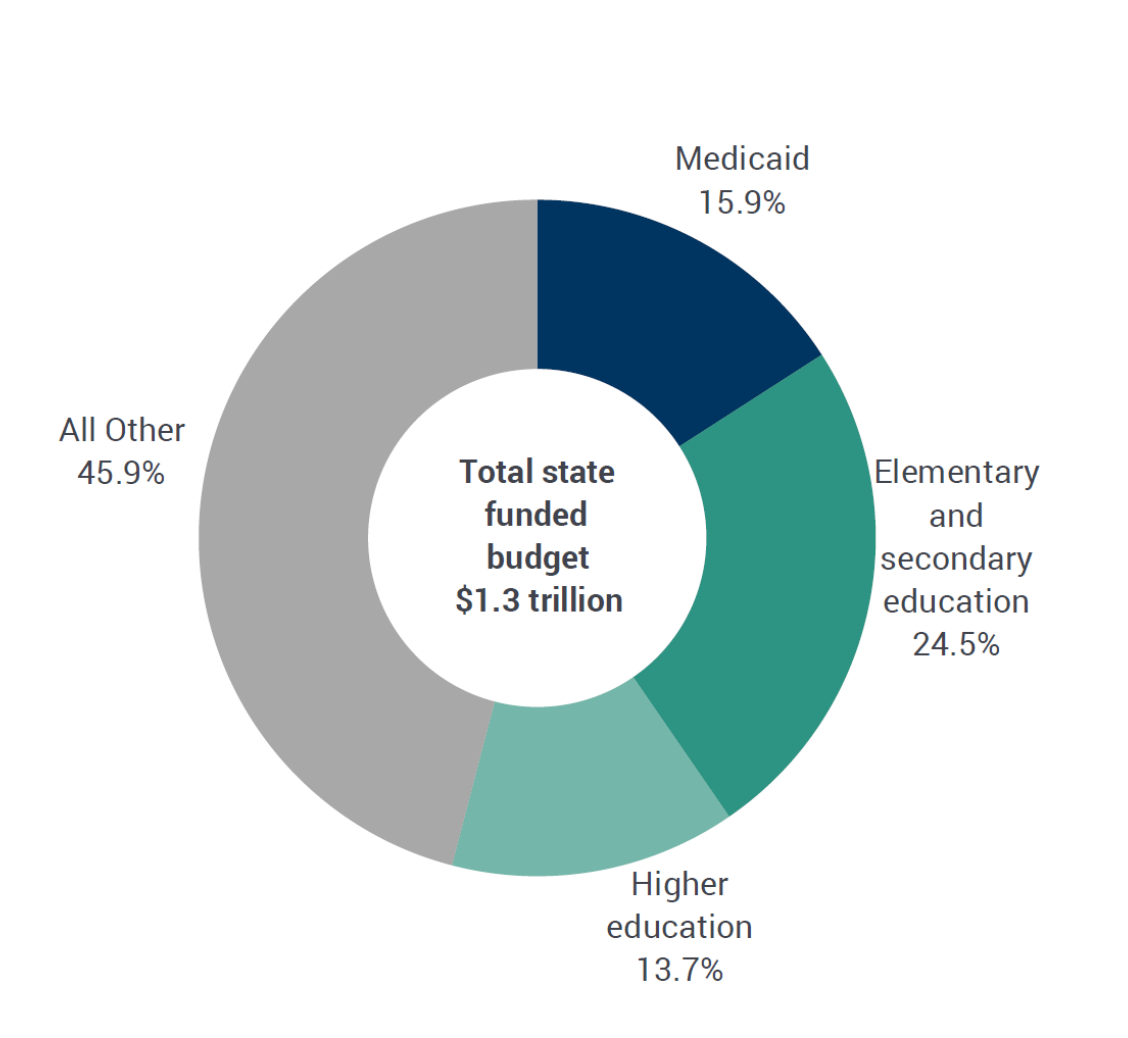

But will it be fiscally sustainable? Medicaid financing is a shared responsibility between the federal government and the states. For most states, Medicaid is second only to primary and secondary education as the largest component in their budgets, which are far more dependent on regressive sales taxes than the federal government.

The time has come to flesh out a tax reform plan that can win popular support in red and blue states alike. Let’s federalize Medicaid and deliver a huge tax relief package to the states.

Federalizing Medicaid could provide as much as $200 billion in relief from regressive state sales and income taxes. The federal taxes needed to finance the switch could be made far more progressive than they are now as part of the plan.

States could use the windfall any way they like. Legislatures could offer sales and income tax relief to their low- and moderate-income citizens. Or they could invest more in education, housing, transportation, and economic development.

As I noted in a 2017 article in Democracy: A Journal of Ideas calling for federalized Medicaid, the nation’s miserly attitude toward basic social services (housing, food assistance, basic mental and behavioral health) is one of the major drivers of ill-health in our society. It helps explain why the U.S. spends so much more than other advanced industrial countries on caring for the sick. Federalizing Medicaid will provide the states whose governments are charged with providing most of those services with new fiscal capacity to meet those needs.

Federalizing Medicaid would also standardize benefits across the country. It makes no sense that a working adult in Texas earning poverty-level wages does not qualify for Medicaid while someone earning significantly more in New York or Massachusetts is not only covered but has a significantly better benefits package.

It also would sharply reduce the administrative staff needed to oversee the differing requirements in each state. A simplified, federally-run program with clear entry and exit criteria would make the lives of the poor and working poor simpler by eliminating the “time tax” needed to fill out the complicated paperwork that state-run Medicaid programs impose to limit their financial exposure. As people get jobs or earn more than poverty-level wages in the jobs they have, a federalized Medicaid program could be structured to allow an easy transition into exchange-based plans when their employers don’t provide coverage.

This reform has been batted around for years. What’s needed now is some think tank to flesh out a full proposal that includes the estimated cost of federalizing Medicaid; the tax reform needed to raise the money; and the state-by-state estimate of the tax relief that will accrue to their budgets; and a full discussion of its social and administrative benefits.

Legislation should be introduced in the next Congress and hearings held in the HELP committee. If Republicans want to talk about block grants, fine. Democrats should show they have a better idea – one that helps the working poor and taxpayers alike.

https://www.blogger.com/blog/post/edit/3936036848977011940/4963644386930103177

How Medicare Advantage plans dodged auditors and overcharged taxpayers by millions

by Fred Schulte and Holly Hacker - Kaiser Health News- September 12, 2022

In April 2016, government auditors asked a Blue Cross Medicare Advantage health plan in Minnesota to turn over medical records of patients treated by a podiatry practice whose owner had been indicted for fraud.

Medicare had paid the Blue Cross plan more than $20,000 to cover the care of 11 patients seen by Aggeus Healthcare, a chain of podiatry clinics, in 2011.

Blue Cross said it couldn't locate any records to justify the payments because Aggeus shut down in the wake of the indictment, which included charges of falsifying patient medical files. So Blue Cross asked the Centers for Medicare & Medicaid Services for a "hardship" exemption to a strict requirement that health plans retain these files in the event of an audit.

CMS granted the request and auditors removed the 11 patients from a random sample of 201 Blue Cross plan members whose records were reviewed.

A review of 90 government audits, released exclusively to KHN in response to a Freedom of Information Act lawsuit, reveals that Blue Cross and a number of other health insurers issuing Medicare Advantage plans have tried to sidestep regulations requiring them to document medical conditions the government paid them to treat.

The audits, the most recent ones the agency has completed, sought to validate payments to Medicare Advantage health plans for 2011 through 2013.

As KHN reported late last month, auditors uncovered millions of dollars in improper payments — citing overcharges of more than $1,000 per patient a year on average — by nearly two dozen health plans.

The hardship requests, together with other documents obtained by KHN through the lawsuit, shed light on the secretive audit process that Medicare relies on to hold accountable the increasingly popular Medicare Advantage health plans — which are an alternative to original Medicare and primarily run by major insurance companies.

Reacting to the audit findings, Sen. Chuck Grassley, R-Iowa, called for "aggressive oversight" to recoup overcharges.

"CMS must aggressively use every tool at its disposal to ensure that it's efficiently identifying Medicare Advantage fraud and working with the Justice Department to prosecute and recover improper payments," Grassley said in a written statement to KHN.

Medicare reimburses Medicare Advantage plans using a complex formula called a risk score that computes higher rates for sicker patients and lower ones for healthier people.

But federal officials rarely demand documentation to verify that patients have these conditions, or that they are as serious as claimed. Only about 5% of Medicare Advantage plans are audited yearly.

When auditors came calling, the previously hidden CMS records show, they often found little or no support for diagnoses submitted by the Advantage plans, such as chronic obstructive pulmonary disease, diabetes or vascular disease. Though auditors look at the records of a relatively small sample of patients, they can extrapolate the error rate to the broad population of patients in the Medicare Advantage health plan and calculate millions of dollars in overpayments.

Overall, CMS auditors flagged diagnostic billing codes — which show what patients were treated for — as invalid more than 8,600 times. The audits covered records for 18,090 patients over the three-year period.

In many cases, auditors found that the medical credentials of the health care provider who made the diagnosis were unclear, the records provided were unacceptable, or the record lacked a signature as required. Other files bore the wrong patient's name or were missing altogether.

The rates of billing codes rejected by auditors varied widely across the 90 audits. The rate of invalid codes topped 80% at Touchstone Health, a defunct New York HMO, according to CMS records. The company also was shown to have the highest average annual overcharges — $5,888 per patient billed to the government.

By contrast, seven health plans had fewer than 10% of their codes flagged.

Health insurers had a wide range of excuses for why records couldn't be turned over to auditors

One Medicare Advantage health plan submitted 57 hardship requests, more than any other insurer, though CMS approved only six. In three cases, the health plans said the records were destroyed in floods. Another cited a warehouse fire, and two said the records couldn't be turned over because a doctor had been convicted for his role in illegally distributing millions of oxycodone pills through his network of pain clinics.

Other Medicare Advantage health plans argued they had no luck retrieving medical records from doctors who had moved, retired, died — and in some cases been arrested or lost their licenses for misconduct.

CMS found most excuses wanting, telling health plans they granted exceptions only in "truly extraordinary circumstances." CMS said it receives about 100 of these requests for each year it audits and approves about 20% of them.

The Medicare Advantage plan issued by Minnesota Blue Cross won its appeal after it relied on Aggeus Healthcare for diagnoses of vascular disease for 11 of its patients who got podiatry care..

Dr. Yev Gray, a Chicago podiatrist who owned the Aggeus chain that operated in more than a dozen states, was indicted on federal fraud charges in Missouri in October 2015.

The indictment accused him of creating an electronic medical record that fraudulently added billing codes for treatment of medical conditions patients didn't necessarily have, including vascular disease.

Gray pleaded guilty in May 2017 to charges of conspiracy to defraud the United States and making false statements related to health care matters. He was sentenced to 90 months in prison.

Blue Cross said it "terminated" its network agreements with Aggeus about two weeks after learning of the indictment. Jim McManus, director of public relations for Blue Cross and Blue Shield of Minnesota, had no comment on the case but said the insurer "is committed to investigating credible cases of fraud, waste, and abuse."

Dara Corrigan, a CMS deputy administrator, said that as a "general matter," its Medicare Advantage audits "are not designed to detect fraud, nor are they intended to identify all improper diagnosis submissions."

Protecting taxpayers: 'That is money that should be recovered'

The costs to taxpayers from improper payments have mushroomed over the past decade as more seniors pick Medicare Advantage plans. CMS has estimated the total overpayments to health plans for the 2011-2013 audits at $650 million, yet how much it will eventually claw back remains unclear.

Payment errors continue to be a drain on the government program. CMS has estimated net overpayments to Medicare Advantage plans triggered by unconfirmed medical diagnoses at $11.4 billion for 2022.

"This isn't a partisan issue," said Sen. Sherrod Brown D-Ohio. "I've requested a plan from CMS as to how they plan to recoup these taxpayer-funded overpayments and prevent future overbilling."

Leslie Gordon, an acting director of health care for the Government Accountability Office, said CMS needs to speed up the audit and appeals process to get quicker results.

"That is money that should be recovered," Gordon told KHN.

As Medicare Advantage faces mounting criticism from government watchdogs and in Congress, the industry has tried to rally seniors to its side while disputing audit findings and research that asserts the program costs taxpayers more than it should.

AHIP, an insurance industry trade group, criticized KHN's reporting on the newly released audits as "misleading," while the pro-industry group Better Medicare Alliance said the audits were "in some cases, more than a decade old."

Jeff De Los Reyes, a senior vice president at GHG Advisors health care consulting group, said he believes the health plans have improved their documentation in recent years. But, he said, "coding is never 100% perfect and there will be errors despite the best of intentions."

Rep. Katie Porter, a Democrat from Southern California and a critic of Medicare Advantage, countered: "When big insurance bills taxpayers for care it never intends to deliver, it is stealing our tax dollars."

https://www.mainepublic.org/npr-news/2022-12-12/how-medicare-advantage-plans-dodged-auditors-and-overcharged-taxpayers-by-millions

Federalizing Medicaid is badly needed and long overdue, and it is a winnable demand. However, I do not see how it would be possible for the federal government to impose either uniform pricing or genuine global budgets without single payer. Goozner seems to be advocating for dragging all providers into Accountable Care Organizations, which in practice do have simply served to give market-driven private entities even more control over patient care.

ReplyDelete