Science Alone Can’t Heal a Sick Society

Dr. Kaufman is a professor of epidemiology at McGill University. He was recently the president of the Society for Epidemiologic Research.

In the winter of 1848, a 26-year-old Prussian pathologist named Rudolf Virchow was sent to investigate a typhus epidemic raging in Upper Silesia, in what is now mostly Poland.

After three weeks of meticulous observation of the stricken populace — during which he carefully counted typhus cases and deaths by age, sex, occupation and social class — he returned with a 190-page report that ultimately blamed poverty and social exclusion for the epidemic and deemed it an unnecessary crisis. “I am convinced that if you changed these conditions, the epidemic would not recur,” he wrote.

Dr. Virchow was only a few years out of medical school, but his report became the foundational document of the new discipline of social medicine. His vision for health went far beyond individuals and the pathogens lurking inside them: He pioneered the careful epidemiological examination of social conditions such as housing, education, diet and lifestyle, and he denounced the rigid social stratification perpetuated at the time by the Catholic Church.

The same conditions of inequality that produced the Silesian typhus epidemic would soon foment a political revolution in Germany, and Dr. Virchow’s investigation helped turn him into a political revolutionary. “Medicine is social science and politics nothing but medicine on a grand scale,” he wrote.

For epidemiologists studying the coronavirus today, that scale is still gauged by the mundane act of counting. The counting starts with descriptive statistics on the daily state of the pandemic — who’s infected, who’s sick, how many have died. And then those numbers are used to forecast the pandemic’s future, which lets officials plan and mobilize resources. Epidemiologists use those data to discern patterns over time and among different groups of people, and to determine reasons some get sick and others don’t. That’s the hard part of epidemiology.

We know that the SARS-CoV-2 virus is the cause of Covid-19, and in that sense the story is very simple. But why does one exposed person get infected and not another? Despite more than 200 million detected cases worldwide, scientists still don’t understand much about transmission, nor what makes an infected person sick enough to be hospitalized, beyond simple demographics like age and sex.

Nearly half a million scientific papers have now been published on Covid-19, and they marshal a dizzying array of hypotheses to explain the patterns observed, but a vast majority of those conjectures quickly fizzle out. Numerous studies early on noted the relative absence of Covid-19 cases in Africa and South Asia, for example, leading to many environmental, genetic and behavioral conjectures, until suddenly African countries and India also were devastated by soaring caseloads. Thus so many epidemiological theories came and went, such as the impacts of altitude and blood type. But one consistent association held on, and it’s the same one that Dr. Virchow found in Upper Silesia: Our current pandemic is socially patterned.

This remains one of the few pervasive observations that consistently describes risks of infection, hospitalizations and death from Covid-19 around the world. Yet while wealth correlates with those who can work from home and order groceries online in rich countries, it explains less well the patterns among larger aggregations of people across states and nations. At this level, it appears that the more salient features that distinguish pandemic severity are relational factors like economic equality and social trust. It comes as no surprise to even the casual observer that the pandemic struck most ferociously in countries ridden with political division and social conflict.

For example, consider the number of excess deaths across countries during the pandemic. Looking at those countries most severely affected, such as Peru, Bolivia, South Africa and Brazil, one sees mostly middle-income countries in political turmoil and with weak social institutions. Countries that had fewer deaths than would be expected based on prepandemic trends, on the other hand, are often richer, but also distinguished by high levels of political cohesiveness, social trust, income equality and collectivism, like New Zealand, Taiwan, Norway, Iceland, Japan, Singapore and Denmark. Many investigators have reached similar conclusions in research within and among countries on measures of political polarization, social capital, trust in government and income inequality.

It makes sense that political polarization hampers effective pandemic response, but this is where explanatory inference gets trickiest, because we epidemiologists exist like everyone else inside the social forces that shape the pandemic. We are citizens as well as scientists, none of us immune to politicization and the way that it distorts perceptions and inferences.

For example, how did the effectiveness of a drug like hydroxychloroquine become a political litmus test, rather than a question for dispassionate clinical study? Nothing is gained when basic scientific and policy questions become ideological footballs to be inflated and tossed around. The United States is the dominant biomedical research entity in the world, and so its flagrant political dysfunction became a global problem. This infused everything that we epidemiologists did with doubt, suspicion and the whiff of partisanship.

Politics has dogged us at every turn in these past 18 months — astonishing failings at the C.D.C. and F.D.A. under political appointees, the politicization of proven interventions like masks and vaccines, and more. Take the return to in-person schooling. By April 2020, over three-quarters of the world’s schoolchildren were at home, yet we quickly learned enough to safely reopen schools for younger children — with measures like masking and ventilation — and this is indeed what happened in much of Canada, Europe and Asia.

But that progress from evidence to policy hit a brick wall in the United States when the Trump administration aggressively promoted resumption of in-person schooling as a crucial step toward economic recovery. When the former president threw his weight behind the priority that children should be back in classrooms, blue-state politicians, teachers unions and many epidemiologists were adamantly opposed. Rational discourse about the policy question became all but impossible. Every interpretation of evidence became colored by the suspicion that it was in the service of a political allegiance.

Science is a social process, and we all live amid the social soup of personalities, parties and power. The political dysfunction that holds America hostage also holds science hostage. Dr. Virchow wrote that “mass disease means that society is out of joint.” Society’s being out of joint means that epidemiological research is out of joint, because it exists inside the same society. This is not a new problem, but the dominant “follow the science” mantra misses the fact that the same social pathology that exacerbates the pandemic also debilitates our scientific response to it.

To restore faith in science, there must be faith in social institutions more broadly, and this requires a political reckoning. Of course one can cite many specific challenges for scientists: The wheels are coming off the peer review system, university research is plagued by commercialization pressures, and so on. But all of these are the symptoms, not the underlying disease. The real problem is simply that sick societies have sick institutions. Science is not some cloistered preserve in the clouds, but is buried in the muck with everything else. This is why, just eight days after his investigation in Upper Silesia, Dr. Virchow went to the barricades in Berlin to fight for the revolution.

Jay S. Kaufman is a professor of epidemiology at McGill University and served as the president of the Society for Epidemiologic Research from July 2020 through June 2021.

https://www.nytimes.com/2021/09/10/opinion/covid-science-trust-us.html

Editor's Note -

I'm posting the following article because I think it represents a good example of the trend that has developed of late to broadly bash the increasingly popular Medicare Advantage option as an addition to the traditional Medicare program. I agree with everything in the article, especially that the MA program represents a real threat to the idea of Medicare for All.

But I think that those who believe that the underlying problem is the structure of the Medicare Advantage plans, especially the use of capitation payments in place of tradtional fee-for-service payments of individual physicians, is the underlying problem.

It is not. The underlying problem with the MA program is the sponsorship of the majority of the plans by large for-profit publicly traded corporations, rather than locally sponsored, non-profit multispecialty medical groups. There are many examples of very popular, highly successful, captitated, non-profit, multi-specialty group practices that have succeeded in the past. The Kaiser Health Plans (although they may now have grown to be too big for their own good), Group Health Cooperative of Puget Sound, the original Harvard Community Health Plan, and the Giesinger Health Plan are just a few examples.

They were the inspiration for the federal HMO act, so effectively advocated by Paul Ellwood and his associates was introduced by Senator Kennedy in 1971, supported by the Nixon administration and was eventually passed into law in 1973 in an era when the overwhelming majority of health care delivery entities and most health insurance companies were not for profit.

The original 1971 Senate version of the HMO bill that eventually passed the Senate in 1973 limited federal support for HMOs to entities that were “non-profit, multi-specialty, pre-paid group and staff model practices” and were locally governed.

Most of the testimony delivered at the Senate hearings on HMOs was favorable to the concept - with the notable exception of the American Medical Association, that were opposed on the grounds that HMOs represented “the corporate practice of medicine” that they opposed on principle, and was illegal at that time in a number of states.

The AMA, recognizing the inevitability of the passage of federal HMO legislation given its broad support by many groups, including the Nixon administration, eventually ended up supporting HMOs modeled after the San Fernando Valley Foundation for Medical Care, that expanded the HMO concept to include loosely structured networks of fee-for-service doctors - such as the Blue Shield plans sponsored, and in many states controlled - by state medical societies. Their version of the HMO structure, that was much less rigorous than the Senate version, was incorporated into the Act that passed the House of Representatives, and was incorporated into the version that ended up in the final HMO law.

Many commentators have claimed that the HMO Act was intended by opponents of national health insurance as a substitute for and way of sabotaging the national health insurance bills that were also being considered by the Congress during the early 1970s.

That, too, is incorrect. The HMO Act was seen by both the Nixon administration and Senator Kennedy as a part of a “three-legged stool” of health reform - reform of the delivery system (The HMO Act - enacted in 1973), the system of federal support for health professions education (The Health Professions Education and Nurse Training Acts - enacted in 1971), and health care financing (National Health Insurance - favored by both Senator Kennedy and the Nixon administration - never enacted.) These three initiatives were always intended to complement each another - not as substitutes for one another.

I know because I was there. I was one of three professional staff tasked with managing legislation being considered by the Subcommittee on Health of the United States Senate from 1971 to 1976 - a period of great legislative activity in the Congress.

My conclusion is that the Medicare Advantage plans are a threat to the idea of a publicly funded health care system because of their overwhelming for-profit, corporate sponsorship - not because of the way they are structured or the mode of payment they employ (pre-payment vs. fee-for-service).

To eliminate them entirely would truly be throwing the baby out with the bath water. There are many advantages to allowing them to function on an annual budget such as the one created by global budgets, capitation payment or, in the case of hospitals, prospectively determined global budgets. They are both ways of controlling total overall healthcare costs for those services directly, thereby reducing or eliminating the odious remote micromanagement of the medical care employed by pre-certification programs, so called value-based payments, disease managment algorithms and other ways of interfering with the practice of medicine that is contributing so much to the cognitive dissonance that is leading to the rising rate of burn-out of health care workers (it isn’t just the paperwork - its also the moral injury.)

But to do that, sponsorship by for-profit, publicly traded entities or hedge funds focused solely on maximizing profitability must be purged from the system if they impinge clinical decisionmaking wherever possible. We must allow only non-profit entities - not driven by an overwhelming and insatiable drive for ever more profits - to function freely in healthcare, and is a vision worth pursuing relentlessly. If we ever wish to solve the problems so well articulated by Thom Hartmann’s article, we have to accurately identify and characterize the underlying pathology that’s creating the behavior (symptoms of dysfunction) - he describes.

That’s the essence of the meaning of the term "diagnosis",

As Lewis Carrol once said "If you don't know where you're going, any road will take you there.

- SPC

Medicare Advantage Is a For-Profit Scam. Time to End It

by Thom Hartmann - Common Dreams - September 8, 2021

Over 100 Democratic lawmakers last week introduced legislation to lower the Medicare eligibility age to 60. There is one small problem that needs fixing, though: so-called "Medicare Advantage."

This week my new book, The Hidden History of American Healthcare: Why Sickness Bankrupts You and Makes Others Insanely Rich is officially available in bookstores nationwide and online. Here's a chapter excerpt I think you'll find interesting, particularly after all those awful TV ads with former football and sitcom stars we've had to endure the past few years…

The "Advantage" War against Medicare

Medicare Advantage is a massive, trillion-dollar rip-off, of the federal government and of taxpayers, and of many of the people buying the so-called Advantage plans.

It's also one of the most effective ways that insurance companies could try to kill Medicare For All, since about a third of all people who think they're on Medicare are actually on these privatized plans instead.

Nearly from its beginning, Medicare has allowed private companies to offer plans that essentially compete with it, but they were an obscure corner of the market and didn't really take off until the Bush administration and Republicans in Congress rolled out the Medicare Modernization Act of 2003. This was the GOP's (and a few corporatist Democrats') big chance to finally privatize Medicare, albeit one bite at a time.

That law created a brand known as Medicare Advantage under the Medicare Part C provision, and a year later it phased in what are known as risk-adjusted large-batch payments to insurance companies offering Advantage plans.

Medicare Advantage plans are not Medicare. They're private health insurance most often offered by the big for-profit insurance companies (although some nonprofits participate, particularly the larger HMOs), and the rules they must live by are considerably looser than those for Medicare.

Even more consequential, they don't get reimbursed directly on a person-by-person, procedure-by-procedure basis. Instead, every year, Advantage providers submit a summary to the federal government of the aggregate risk score of all their customers and, practically speaking, are paid in a massive lump sum.

The higher their risk score, the larger the payment. A plan with mostly very ill people in it will get much larger reimbursements than a plan with mostly healthy people. After all, the former will be costly to keep alive and healthy, while the latter won't cost much at all.

Profit-seeking insurance companies, being the predators that they are, have found a number of ways to raise their risk scores without raising their expenses. The classical strategies of tying people to in-network providers, denying procedures routinely during first-pass authorization attempts, and having very high out-of-pocket caps are carried over from regular health insurance systems to keep costs low and profits high.

But with Medicare Advantage, the big insurance companies have invented a whole new way to rip us all off while padding their bottom lines.

For example, many Medicare Advantage plans promote an annual home visit by a nurse or physician's assistant as a "benefit" of the plan. What the companies are doing, though, is trying to upcode their customers to make them seem sicker than they are to increase their overall Medicare reimbursement risk score.

"Heart failure," for example, can be a severe and expensive condition to treat . . . or a barely perceptible tic on an EKG that represents little or no threat to a person for years or even decades. Depression is similarly variable; if it lasts less than two weeks, there's no reimbursement; if it lasts longer than two weeks, it's called a "major depressive episode" and rapidly jacks up a risk score.

The home health visits are designed more to look for illnesses or codings that can increase risk scores than to find conditions that require medical intervention. They're so profitable that an entire industry has sprung up of companies that send nurses out on behalf of the smaller insurance companies.

In summer 2014, the Center for Public Integrity (CPI) published an in-depth investigative report titled Why Medicare Advantage Costs Taxpayers Billions More Than It Should.

They found, among other things, that one of the most common scams companies were running involved that very scoring of their customers as being sicker than they actually were, so that their reimbursements were way above the cost of caring for those people.

Here are a few quotes from the report:

-

"Risk scores of Medicare Advantage patients rose sharply in plans in at least 1,000 counties nationwide between 2007 and 2011, boosting taxpayer costs by more than $36 billion over estimated costs for caring for patients in standard Medicare."

-

"In more than 200 of these counties, the cost of some Medicare Advantage plans was at least 25 percent higher than the cost of providing standard Medicare coverage."

-

The report documents how risk scores rose twice as fast for people who joined a Medicare Advantage health plan as for those who didn't.

-

Patients, the report lays out, never know how their health is rated because neither the health plan nor Medicare shares risk scores with them—and the process itself is so arcane and secretive that it remains unfathomable to many health professionals.

-

"By 2009, government officials were estimating that just over 15 percent of total Medicare Advantage payments were inaccurate, about $12 billion that year."

-

Based on its own sampling of data from health plans, the report shows how CMS has estimated that faulty risk scores triggered nearly $70 billion in what officials deemed "improper" payments to Medicare Advantage plans from 2008 through 2013.

-

CMS decided, according to the report, not to chase after overcharges from 2008 through 2010 even though the agency estimated through sampling that it made more than $32 billion in "improper" payments to Medicare Advantage plans over those three years. CMS did not explain its reasoning.

-

The report documents how Medicare expects to pay the health plans more than $150 billion this year [2014, the year the study was published].

Companies are almost never nailed for these overcharges, and when they are, they usually pay back pennies on the dollar.

For example, when the Office of Inspector General, Health and Human Services (which oversees Medicare), audited six out of the hundreds of plans on the market in 2007, they found that just those six companies "had been overpaid by an estimated $650 million" for that one year. As the Center for Public Integrity states, "CMS settled five of the six audits for a total repayment of just over $1.3 million."

The Centers for Medicare and Medicaid Services also, in 2012, decided to audit only 30 plans a year going forward. As CPI noted, "At that rate, it would take CMS more than 15 years to review the hundreds of Medicare Advantage contracts now in force." And that's 15 years to audit just one year's activity!

Things haven't improved since that 2014 investigative report from CPI. In September 2019, Senator Sherrod Brown of Ohio and five Democratic colleagues sent a letter to President Donald Trump's CMS administrator, Seema Verma.

"The recent HHS Payment Accuracy Report exposes that taxpayers have overpaid Medicare Advantage plans more than $30 billion dollars over the last three years," Brown wrote. "This report comes on the heels of a 2016 Government Accountability Office (GAO) report and a 2013 GAO report on [Medicare Advantage] plan overcharges and the failure of the Centers for Medicare and Medicaid (CMS) to recoup billions of dollars of improper payments from MA plans."

Meanwhile, during the four years of the Trump administration, CMS went out of their way to illegally promote Medicare Advantage plans (which typically cost CMS far more than a regular Medicare plan).

A February 2020 report in the New York Times stated, "Under President Trump, some critics contend, the Centers for Medicare and Medicaid Services, which administers Medicare, has become a cheerleader for Advantage plans at the expense of original Medicare."

The report pointed to the draft release of the 2019 Medicare & You handbook, which is mailed every year to all enrollees and posted online. "Advocates and some lawmakers criticized language describing Advantage as a less expensive alternative to original Medicare."

The National Bureau of Economic Research (NBER) compared Medicare Advantage with traditional Medicare and found the Advantage programs to be mind-bogglingly profitable: "MA insurer revenues are 30 percent higher than their healthcare spending. Healthcare spending for enrollees in MA is 25 percent lower than for enrollees in [traditional Medicare] in the same county and [with the same] risk score."

At the same time, Medicare Advantage often screws its customers. According to the NBER study, people with Medicare Advantage got 15 percent fewer colon cancer screening tests, 24 percent fewer diagnostic tests, and 38 percent fewer flu shots.

Speculation is rife as to why CMS would allow—much less promote—privatized plans that cost Medicare far more than original Medicare to rip off taxpayers to the tune of billions of dollars a month.

One possibility is regulatory capture—people working in CMS know that if they go along and get along, very well-paid jobs are waiting for them at for-profit insurance companies after a few years of government service. This is a chronic problem at other regulatory agencies, particularly those overseeing pollution, pharmaceuticals, telecommunications, and banking.

Another answer is that the Bush administration—where Medicare Advantage started—was so enamored of the idea of privatizing Medicare to eventually destroy the program (George W. Bush campaigned extensively from the late 1970s through his presidency to privatize both Social Security and Medicare) that they turned a blind eye to abuses.

The Obama administration had other priorities, as they were trying to push through the Affordable Care Act and didn't want to upset the apple cart. And when Trump came into power, his folks saw anything that drained resources out of Medicare and into the pockets of multimillionaire health insurance executives—a group notoriously generous when it comes to making political contributions—as a plus.

You Are Locked in to Medicare Advantage

A fellow I'd known decades ago recently bubbled back into conversation among a few of us who'd hung out together in New York back in the 1970s. Sam, I'll call him, had turned 65 and hadn't had employer-provided health insurance in years. He spent a few hours trying to figure out how to sign up for Medicare and then gave up, totally confused, figuring he'd try again in a few months.

Unfortunately, his prostate intervened. When Sam started experiencing pain urinating, he visited a local "doc in a box" urgent care clinic, where they gave him a PSA test. The result was shocking: his PSA was so high that it was a virtual certainty he had prostate cancer, and possibly it had even metastasized, a situation that is the second-leading cause of cancer death in American men.

Telling him that he'd be facing hefty doctor and hospital bills regardless of the outcome, the urgent care clinic signed him up for a Medicare Advantage plan offered by an affiliate that almost certainly paid them a commission for the sign-up. Sam was excited, though, because he now had insurance, and it was a "no dollar" plan that didn't cost him a penny.

Sam then got on the phone to find a urologist who specialized in cancer. He found that the best worked out of Memorial Sloan Kettering Cancer Center in New York, and, telling them he was "on Medicare," he made an appointment to see one of their top docs. A month later, when his appointment finally opened up, the person who was checking him into the system told him that he'd have to pay cash because his Advantage plan didn't include Sloan Kettering.

In fact, more than a third of all Medicare Advantage plans nationwide do not include any of the National Cancer Institute centers, and none of the Advantage plans offered in the New York City area include the nation's most famous one, Memorial Sloan Kettering Cancer Center.

Shocked, Sam contacted Medicare to see if he could transfer from Medicare Advantage to regular Medicare. This all happened in fall 2020, so they told him that he could make the change during the "open enrollment period" of October 15 to December 7. He made the change and called Sloan Kettering back.

This time, they wanted to know what Medigap policy he'd signed up for to fill in the 20 percent of billing that Medicare doesn't cover. That sent Sam back to the internet and, ultimately, to an insurance agent, who told him that while Medigap plans can't refuse you because of preexisting conditions when you first sign up when you turn 65, if you shift from Medicare Advantage back to traditional Medicare after that first enrollment, particularly if you're older or sick, they can simply refuse to cover you.

Reporter Mark Miller wrote for the New York Times in February 2020 about Ed Stein, a 72-year-old man with bladder cancer and a Medicare Advantage plan that didn't cover the cancer docs in his area who specialized in his type of cancer. He tried to shift back to traditional Medicare to cover what promised to be complex and expensive surgery and chemotherapy. As Miller wrote, "That was when he ran up against one of the least understood implications of selecting Advantage when you enroll in Medicare: The decision is effectively irrevocable."

As of this writing (November 2020), my friend Sam still hasn't seen a doctor. This is the state of healthcare in America as it's been sliced and diced by the multibillion-dollar insurance industry.

Meanwhile, every fall, Americans are inundated with hundreds of millions of dollars' worth of TV, direct mail, and internet advertising for Medicare Advantage plans. And where does the money come from to pay for that advertising?

It comes from the same place that provided over $1 billion in wealth to the former CEO of United Healthcare, and over $100 million a month in compensation to senior executives in the largest health insurance companies: denying claims while collecting risk adjustment claims from your tax dollars and mine.

The simple solution to the Medicare Advantage problem is to kill off the program. It was just a Trojan horse to privatize Medicare, and its presence will make Medicare for All even harder to implement. At the same time, the 20 percent hole that the GOP insisted on for skin in the game with real Medicare needs to go, too.

A comprehensive Medicare for All program will eliminate both of these problems.

https://portside.org/2021-09-09/medicare-advantage-profit-scam-time-end-it

Biden Administration Goes Bigger on Cutting Drug Prices

The administration endorses a proposal for the government to negotiate on prices for all U.S. purchasers, not just Medicare.

by Margot Sanger Katz - NYT - September 9, 2021

The Biden administration on Thursday endorsed an aggressive proposal to limit prices for prescription drugs, calling for the government to negotiate with drug makers on prices and applying those prices not just to Medicare but to all drug purchasers in the country.

The proposal, published as a 29-page white paper from the Department of Health and Human Services, was included a range of recommendations to foster more competition among drugmakers and improve the affordability of drugs for patients enrolled in Medicare.

The administration cannot make such large changes on its own; it amounts to a signal to congressional Democrats. Democratic leaders in Congress have suggested that they hope to regulate prices in some way as part of the $3.5 trillion legislative package now being considered. The House passed a bill with similar provisions in 2019, but senators working on the package have released few policy details as they wrestle with their approach.

Steve Ubl, the C.E.O. of the industry trade group PhRMA, called the policy “an existential risk to the industry.” Major across-the-board price reductions would result in reduced revenues for drug companies, and could hurt companies’ ability to spend on research as well as cause smaller companies to close if investors leave the sector, he said. His group and the companies it represents have mobilized to fight such a plan.

Drug price regulation represents a crucial piece of the still-developing Democratic package because it is one of the few proposed policies that could reduce, rather than increase, federal spending.

Any policy that substantially reduces drug prices has the potential to save the government a lot of money. The federal government pays a large share of drugs for patients with Medicare, and subsidizes insurance plans that purchase drugs for other Americans.

This new approach could help fund other expensive priorities, such as expanding Medicare benefits to cover dental care, and providing insurance coverage to uninsured people in states that have not expanded Medicaid. An approach that lowers drug prices less would leave less funding available for those other goals.

High prescription drug prices are a major consumer issue, one that voters consistently identify as a top concern. Reducing their prices could matter for many American households.

But broad price controls like the one endorsed by the white paper could encounter both political and logistical problems. The pharmaceutical industry has long opposed government price negotiations of any sort in the United States, and some Democratic lawmakers are sympathetic to their concerns that price restrictions could stymie innovation and hamper future drug development.

Democrats are also hoping to pass their package through a special procedure known as budget reconciliation. That process would allow them to pass the bill without needing to overcome a legislative filibuster in the Senate, but it comes with a series of special rules. Price negotiations outside the Medicare program may be hard to achieve using that process.

While most other Western governments negotiate directly with companies over prices, the United States has done so only in very limited contexts. Medicare is currently barred from negotiating over drug prices under law. Most commercial health plans negotiate with drug companies for discounts below their advertised prices, but their success varies depending on the type of drug and the number of choices on the market.

In general, American drug purchasers pay substantially higher prices for drugs than their counterparts in other developed countries. A recent paper from the RAND Corporation cited in the government proposal estimates that prescription drugs in the United States cost more than 250 percent of the prices paid by other countries in the Organization for Economic Cooperation and Development.

The paper is somewhat silent on the details of how the health secretary should negotiate or establish fair prices for drugs. But Congress will need to be more specific if it pursues such legislation. In 2019, the House passed a bill that would establish price limits for certain drugs based on what other countries pay, but that bill was not taken up in the Republican-led Senate.

President Biden has identified drug prices as a health care priority for his administration. Thursday’s paper comes in response to a July executive order calling for action on the issue. Mr. Biden also gave a speech last month calling for price negotiations, and limitations on drug price increases, another policy listed in the paper. From the time of his presidential campaign, Mr. Biden has called for Medicare to negotiate with drugmakers on prices, but the call for the government to negotiate on prices for all U.S. purchasers goes further than his campaign proposal.

Drug prices were also a priority for President Donald J. Trump, whose Health and Human Services department released its own blueprint for policies to reduce drug prices. The Trump administration proposed several regulations and demonstration projects to address the issue, but it was unable to persuade Congress to take legislative action.

Democrats’ Stumble on Drug Prices Shows Power of Industry

An attempt in the House to take a bite out of drug companies meets resistance.

by Margot Sanger-Katz - NYT - September 15, 2021

House Democrats writing the health provisions of their big social spending bill aimed high: new coverage for poor Americans without insurance; extra subsidies for people who buy their own coverage; and new dental, hearing and vision benefits for older Americans through Medicare.

To pay for those, they also aimed high when it came to lowering drug prices. A measure that would link the prices of certain prescription drugs to those paid overseas was devised to save the government enough money to offset the costs of those other priorities. The House approach, estimates suggest, could save the government around $500 billion over a decade, with that money coming out of the pockets of the pharmaceutical industry.

But it’s risky to bet against the drug companies.

Three House Democrats on a key committee voted against the measure on Wednesday. There are still ways for House leaders to keep the provision in the final bill, but the House Democratic majority is so slim that those three legislators, if determined, could represent a significant barrier to passing the broader package.

The dynamic is familiar to lawmakers who have worked on health issues: Health industries are large and powerful lobbies, and they do not enjoy having their revenues cut. As with measures that might reduce payments to hospitals, doctors and insurance companies, the House’s attempt to take a bite out of drug companies has generated a backlash.

“I just don’t think paying for a lot of things by crippling investments in life sciences is really the way to go forward,” Representative Scott Peters, Democrat of California, told my colleague Emily Cochrane on Tuesday. “Losing the investment in pharma is too big a price to pay.” (Kurt Schrader of Oregon and Kathleen Rice of New York are the other House Democrats who voted against the measure.)

Mr. Peters’s district in the San Diego area includes tens of thousands of workers in medical research and drug development. Some might lose their jobs if pharmaceutical profits shrank, research investments dwindled or companies closed their doors. Mr. Peters has co-sponsored a competing drug pricing bill, which he argues would better target inefficiencies and market failures. The budgetary effects of that legislation have not been measured — and the House committee did not vote on it Wednesday — but it is similar to a Senate bill that was estimated to generate a fifth as much savings.

Without the drug pricing provision, Democrats will have a tough time financing their other priorities. They are passing their bill using a special budget procedure to avoid a Republican filibuster. But that process means their bill has to hit specified budget targets. If the money saved from drug price regulation is reduced, so, too, is the pot of money that can be spent on other goals. Democrats have already abandoned plans for some other revenue-generating policies, like a wealth tax.

The United States pays higher prices for prescription drugs than any of its peers — about 250 percent of the price paid on average by other Organization for Economic Cooperation and Development countries, according to a recent report from the RAND Corporation. And those high costs ripple through the federal budget and the economy, increasing insurance premiums, and putting lifesaving medications out of reach for some patients.

Democrats in Congress want to lower the drug prices that Medicare and other insurers pay, both to generate a way to pay for other things and also to benefit general consumers and businesses.

But lowering drug prices does come with trade-offs. Drug company businesses are built around assumptions of high margins in U.S. markets, and investors in early stage companies make choices based on their expectation that a drug that works will generate a big payday. The Congressional Budget Office — the same nonpartisan agency that told the House such a policy could save the federal government lots of money — recently released a report indicating that substantial drug price reductions would have corresponding negative effects on the number of new drugs developed in the future.

Naturally, the pharmaceutical industry is not happy about the prospect of large price cuts. Steve Ubl, the C.E.O. of the industry trade group PhRMA, described the measure last week as “existential” to his industry. He also said it was unfair that drug companies alone were being asked to shoulder the costs of such a large health care expansion. “We’re being asked to pay a disproportionate share of the bill,” he said.

The drug industry has spent years donating to political campaigns, lobbying members of Congress, and developing allies in the business community. They are now urgently leveraging those relationships. PhRMA announced a “seven-figure” advertising buy on Wednesday, and published an open letter in several Washington publications, adding to television ads running on national news programs and football broadcasts.

It’s a playbook that other powerful health lobbies have used. Groups representing doctors, hospitals and private equity firms started an enormous campaign in 2019 to defeat bipartisan legislation to ban the practice of surprise medical billing. Their efforts stopped the ban, though Congress ultimately passed a more industry-friendly version a year later.

Leaders in the Senate have signaled that they want to pursue their own approach to drug price regulation. Whether their measure will differ in the policy fine print or in the magnitude of the cut to pharmaceutical profits remains to be seen. But the House has been generally perceived as more aggressive on the issue. Its difficulties this week could signal a softer approach, and perhaps a smaller budget for Congress and the White House’s other lofty goals.

https://www.nytimes.com/2021/09/15/upshot/democrats-stumble-drug-prices.html

European Healthcare and M4A – Healthcare-NOW!

Universal Healthcare is Public Healthcare

Media, pundits, and legislators claim we can "build on the

current system" to achieve universal healthcare coverage, and that there

are "multiple pathways" which don't require eliminating for-profit,

employer-based insurance. Proponents often cite European countries like Switzerland, Germany and the Netherlands as examples of countries that have achieved universal coverage without single payer.

The truth is that none of our peer countries have achieved universal healthcare through a private, for-profit insurance system. Most high-income countries run single payers; the ones that do not rely on sickness funds or other quasi-public institutions rather than private insurers. This project looks more closely at those healthcare systems and examines how exactly they provide universal coverage for their residents.

Most European Countries Have Single Payer

Most of the 35 countries in the European Union and the Schengen agreement have single payer healthcare systems. And in every country but Slovakia, primary coverage is provided by public or quasi-public entities.

Supplemental insurance (or "top-up" insurance) is sold in almost every healthcare system, and is sometimes delivered by profit-making entities; but because it covers so little (typically copays, extra costs for vision and dental treatments, or "extras" like a private hospital room) it's a very small percentage of overall health spending, generally at 5% or less. See our Citations.

27 countries run single payer systems

6 other countries, including Switzerland and Germany, allow sickness funds or quasi-public entities to provide primary health coverage

1 country allows for-profit insurers to provide primary coverage: Slovakia

Private Insurers Can't Deliver Universal Care

Except Slovakia, all of Europe uses public or quasi-public entities to administer the government's healthcare plan.

Belgium, Germany, Switzerland, Netherlands, & Czechia use quasi-public insurers that are or were formerly sickness funds.

The following features differentiate them from truly private entities:

- GOVERNMENT MANAGES RISK

- Corporate insurers (Aetna, Cigna), and even private, non-profit insurers (Blue Cross) - take on risk. They have an incentive to recruit for and select healthy, inexpensive customers. With public insurers, risk is largely managed by the government through central risk pooling. Funds are pooled and redistributed according to the risk profile of each insurers' members. Pooling risk is essential to the stability and incentives of the system; this is why every European country pools risk across insurers. Pooling also removes the incentive to cherry-pick.

- PROFITS ARE ILLEGAL

- Private insurers are free to make a profit off the business of health insurance; public insurers are outlawed from profit-making on standard coverage.

- COMPETITION IS LIMITED

- Private insurers make operating decisions like what to cover and for how much. Most working Americans are covered by self-insured private plans, which are exempt from many federal regulations (including key parts of the ACA). Public and quasi-public insurers, on the other hand, are largely constrained by a nationally-set benefits package and fee schedule which makes coverage equitable and uniformly comprehensive.

Public Regulation - not Private Competition - Controls Costs

In addition to the regulations on insurers, the following system-wide cost controls are standard in Europe:

-

-

-

- Physicians are paid according to a fee schedule (or salary level) negotiated nationally

- Hospital care is also largely reimbursed through standardized rates (DRGs), almost always negotiated nationally

- Pharmaceutical prices are negotiated and set nationally

- Nationally-determined spending caps on hospital care, or global budgeting of hospitals/the health system

- Mark-ups for pharmaceuticals are regulated at both the retail and wholesaler level

- Physicians are paid according to a fee schedule (or salary level) negotiated nationally

-

-

Providing everyone with care that is truly comprehensive and

continuous from cradle to grave requires strict control of costs at the

national level. Universal coverage is unsustainable without government

planning.

What it will take to move us to a Dutch or German system?

None of the incremental reforms currently proposed in the U.S. Congress would get us to even the imperfect Dutch healthcare system - where 80% of all health expenditure is public.

To transition to the Netherlands system, here are some steps we'd need to take:

Step 1: Institute a payroll tax to cover 50% of the insurance plan. Flat premiums of around $120 per month would also be instituted, accounting for 45% of total spending. About 57% of households will receive subsidies to help cover this cost, to be funded through a different tax.

Step 2: Budget for and finance long-term care nationally, through taxation

Step 3: Cover all children through fully-public funds

Step 4: Institute a fixed annual growth rate set for hospitals, primary care, and other sectors, set by the Minister of Health

Step 5: Prevent insurers from making profits on the statutory package, requiring them to:

- Accept government redistribution of their funds

- Cover everything in the state-determined benefits package

- Provide primary care as free at point of delivery

- Abide by maximum prices set by the state

- Abide by their budget, which is set by the Health Minister

None of the incremental reforms currently proposed in the U.S. Congress would get us to even the imperfect German healthcare system.

To transition to the German system, here are some steps we'd need to take:

Step 1: Institute a payroll tax for payment of the plan, collected by the state, which redistributes the resources to the funds according to the risk profile of their members

Step 2: Budget for and finance long-term care nationally, through taxation

Step 3: Institute a fixed annual growth rate set for hospitals, set by the Minister of Health

Step 4: Convert our for-profit & private health insurers to non-profit sickness funds, requiring them to:

- Transfer all their funds to the Central Reallocation Pool, to be redistributed

- Cover everything in the state-determined benefits package; prior authorization is prohibited

- Charge a maximum copay of 10 euro for most care including outpatient visits, inpatient (per day), prescription drugs, rehab, and emergency care.

- Abide by maximum prices set by the state

- Abide by their budget, which is set by the Health Minister

Single Payer Systems are the Fairest & Most Efficient

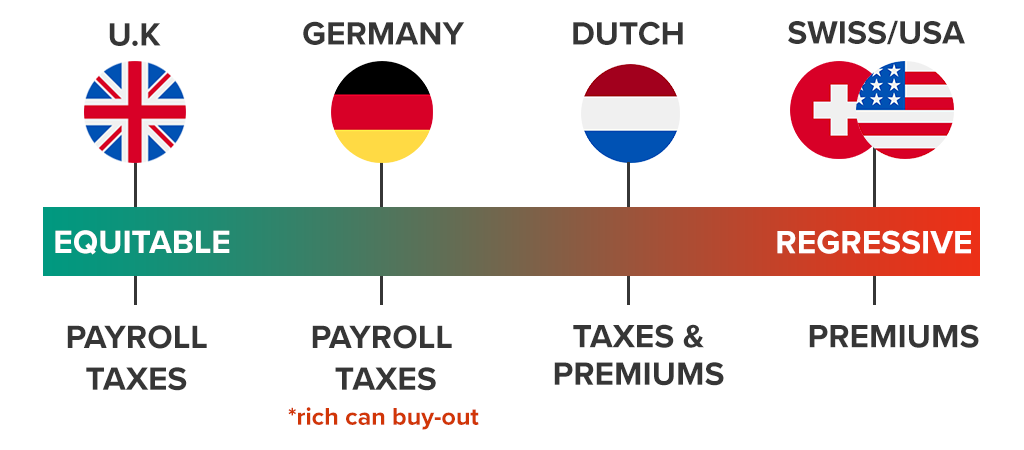

Multipayer systems aren't just less efficient and more costly; they're also regressively financed.

Progressive income taxation ensures that people pay according to their means. A monthly premium system, which requires people to pay the same amount for the same product regardless of their income, means that a middle class family will spend significantly more of their income on healthcare than, for example, Jeff Bezos or Bill Gates.

This is a snapshot of how various EU healthcare systems are financed:

United Kingdom: payroll-based financing system; patients pay a fixed percentage of their income

Germany: payroll-based system; but wealthier patients can opt-out from the system to buy private insurance

The Netherlands: 50% of the insurance system is financed through progressive payroll taxation. The other 50% is financed through flat, regressive premiums. Subsidies and spending caps apply for the lowest income, but lower-middle and middle class patients are disproportionately burdened while wealthier patients pay much less of their household budget for care.

Switzerland: Health insurance is largely financed through flat, regressive premiums. Subsidies and spending caps apply for the lowest income, but lower-middle and middle class patients are disproportionately burdened while wealthier patients pay much less of their household budget for care; in 2016, 22% of the Swiss population reported going without needed health care because of costs, with this rate being particularly high among people with low-income (31%).

The premium payment system is not only wasteful and adds needless administration; it also provides another avenue for insurers to cut off care.

"Medicare For Some": Neither Universal Nor Sustainable

"Medicare for some" bills tinker around the edges of for-profit multipayers and don't include strong national regulation on spending.

Several pieces of legislation have been introduced recently, all purporting to achieve universal healthcare. Almost all of them retain the current system of for-profit insurers, and only the Medicare for All bills actually institute nationwide regulation on spending.

Only a National Medicare for All Can Prevent Unnecessary Deaths

Under a premium payment system (rather than a tax-funded system), if you fail to pay every month - or if the insurer makes an error - your coverage can be cut off at any time. When Danny Desnoyers missed a $20 Medicaid premium (a private insurer was running his plan), they dropped his coverage and he was left without his expensive anti-depressant. After rationing for a couple weeks, he completely ran out and shortly after committed suicide.

Imagine if our public education system was financed like our healthcare system. If you couldn't or forgot to pay your monthly premium, your children wouldn't go to school that month. During periods of unemployment or a strained household budget, they might go months or even years missing education. That's exactly how our healthcare system works.

Most countries never allow this to happen; they guarantee cradle to grave coverage by financing their healthcare systems through taxation independent of a patient's employment status or wage.

Medicare for America and public option plans allows the abuses in the current system to continue by preserving private entities' management of healthcare access. Only a taxpayer-funded plan would ensure continuous, irrevocable coverage, including during times of financial distress - the times one may most likely need a guarantee of healthcare.

https://www.healthcare-now.org/euhealthcare/#

Phony Diagnoses Hide High Rates of Drugging at Nursing Homes

At least 21 percent of nursing home residents are on antipsychotic drugs, a Times investigation found.

Katie Thomas, Robert Gebeloff and

The handwritten doctor’s order was just eight words long, but it solved a problem for Dundee Manor, a nursing home in rural South Carolina struggling to handle a new resident with severe dementia.

David Blakeney, 63, was restless and agitated. The home’s doctor wanted him on an antipsychotic medication called Haldol, a powerful sedative.

“Add Dx of schizophrenia for use of Haldol,” read the doctor’s order, using the medical shorthand for “diagnosis.”

But there was no evidence that Mr. Blakeney actually had schizophrenia.

Antipsychotic drugs — which for decades have faced criticism as “chemical straitjackets” — are dangerous for older people with dementia, nearly doubling their chance of death from heart problems, infections, falls and other ailments. But understaffed nursing homes have often used the sedatives so they don’t have to hire more staff to handle residents.

The risks to patients treated with antipsychotics are so high that nursing homes must report to the government how many of their residents are on these potent medications. But there is an important caveat: The government doesn’t publicly divulge the use of antipsychotics given to residents with schizophrenia or two other conditions.

With the doctor’s new diagnosis, Mr. Blakeney’s antipsychotic prescription disappeared from Dundee Manor’s public record.

Eight months following his admission with a long list of ailments — and after round-the-clock sedation, devastating weight loss, pneumonia and severe bedsores that required one of his feet to be amputated — Mr. Blakeney was dead.

A New York Times investigation found a similar pattern of questionable diagnoses nationwide. The result: The government and the industry are obscuring the true rate of antipsychotic drug use on vulnerable residents.

The share of residents with a schizophrenia diagnosis has soared 70 percent since 2012, according to an analysis of Medicare data. That was the year the federal government, concerned with the overuse of antipsychotic drugs, began publicly disclosing such prescriptions by individual nursing homes.

Today, one in nine residents has received a schizophrenia diagnosis. In the general population, the disorder, which has strong genetic roots, afflicts roughly one in 150 people.

Schizophrenia, which often causes delusions, hallucinations and dampened emotions, is almost always diagnosed before the age of 40.

“People don’t just wake up with schizophrenia when they are elderly,” said Dr. Michael Wasserman, a geriatrician and former nursing home executive who has become a critic of the industry. “It’s used to skirt the rules.”

Some portion of the rise in schizophrenia diagnoses reflects the fact that nursing homes, like prisons, have become a refuge of last resort for people with the disorder, after large psychiatric hospitals closed decades ago.

But unfounded diagnoses are also driving the increase. In May, a report by a federal oversight agency said nearly one-third of long-term nursing home residents with schizophrenia diagnoses in 2018 had no Medicare record of being treated for the condition.

For nursing homes, money is on the line. High rates of antipsychotic drug use can hurt a home’s public image and the star rating it gets from the government. Medicare designed the ratings system to help patients and their families evaluate facilities using objective data; a low rating can have major financial consequences. Many facilities have found ways to hide serious problems — like inadequate staffing and haphazard care — from government audits and inspectors.

One result of the inaccurate diagnoses is that the government is understating how many of the country’s 1.1 million nursing home residents are on antipsychotic medications.

According to Medicare’s web page that tracks the effort to reduce the use of antipsychotics, fewer than 15 percent of nursing home residents are on such medications. But that figure excludes patients with schizophrenia diagnoses.

To determine the full number of residents being drugged nationally and at specific homes, The Times obtained unfiltered data that was posted on another, little-known Medicare web page, as well as facility-by-facility data that a patient advocacy group got from Medicare via an open records request and shared with The Times.

The figures showed that at least 21 percent of nursing home residents — about 225,000 people — are on antipsychotics.

The Centers for Medicare and Medicaid Services, which oversees nursing homes, is “concerned about this practice as a way to circumvent the protections these regulations afford,” said Catherine Howden, a spokeswoman for the agency, which is known as C.M.S.

“It is unacceptable for a facility to inappropriately classify a resident’s diagnosis to improve their performance measures,” she said. “We will continue to identify facilities which do so and hold them accountable.”

Representatives for nursing homes said doctors who diagnose patients and write the prescriptions to treat them are to blame, even though those doctors often work in partnership with the nursing homes.

“If physicians are improperly diagnosing individuals with serious mental health issues in order to continue an antipsychotic regimen, they should be reported and investigated,” Dr. David Gifford, the chief medical officer at the American Health Care Association, which represents for-profit nursing homes, said in a statement.

Medicare and industry groups also said they had made real progress toward reducing antipsychotic use in nursing homes, pointing to a significant drop since 2012 in the share of residents on the drugs.

But when residents with diagnoses like schizophrenia are included, the decline is less than half what the government and industry claim. And when the pandemic hit in 2020, the trend reversed and antipsychotic drug use increased.

A Doubled Risk of Death

For decades, nursing homes have been using drugs to control dementia patients. For nearly as long, there have been calls for reform.

In 1987, President Ronald Reagan signed a law banning the use of drugs that serve the interest of the nursing home or its staff, not the patient.

But the practice persisted. In the early 2000s, studies found that antipsychotic drugs like Seroquel, Zyprexa and Abilify made older people drowsy and more likely to fall. The drugs were also linked to heart problems in people with dementia. More than a dozen clinical trials concluded that the drugs nearly doubled the risk of death for older dementia patients.

In 2005, the Food and Drug Administration required manufacturers to put a label on the drugs warning that they increased the risk of death for patients with dementia.

Seven years later, with antipsychotics still widely used, nursing homes were required to report to Medicare how many residents were getting the drugs. That data is posted online and becomes part of a facility’s “quality of resident care” score, one of three major categories that contribute to a home’s star rating.

The only catch: Antipsychotic prescriptions for residents with any of three uncommon conditions — schizophrenia, Tourette’s syndrome and Huntington’s disease — would not be included in a facility’s public tally. The theory was that since the drugs were approved to treat patients with those conditions, nursing homes shouldn’t be penalized.

The loophole was opened. Since 2012, the share of residents classified as having schizophrenia has gone up to 11 percent from less than 7 percent, records show.

The diagnoses rose even as nursing homes reported a decline in behaviors associated with the disorder. The number of residents experiencing delusions, for example, fell to 4 percent from 6 percent.

A Substitute for Staff

Caring for dementia patients is time- and labor-intensive. Workers need to be trained to handle challenging behaviors like wandering and aggression. But many nursing homes are chronically understaffed and do not pay enough to retain employees, especially the nursing assistants who provide the bulk of residents’ daily care.

Studies have found that the worse a home’s staffing situation, the greater its use of antipsychotic drugs. That suggests that some homes are using the powerful drugs to subdue patients and avoid having to hire extra staff. (Homes with staffing shortages are also the most likely to understate the number of residents on antipsychotics, according to the Times’s analysis of Medicare data.)

The pandemic has battered the industry. Nursing home employment is down more than 200,000 since early last year and is at its lowest level since 1994.

As staffing dropped, the use of antipsychotics rose.

Even some of the country’s leading experts on elder care have been taken aback by the frequency of false diagnoses and the overuse of antipsychotics.

Barbara Coulter Edwards, a senior Medicaid official in the Obama administration, said she had discovered that her father was given an incorrect diagnosis of psychosis in the nursing home where he lived even though he had dementia.

“I just was shocked,” Ms. Edwards said. “And the first thing that flashed through my head was this covers a lot of ills for this nursing home if they want to give him drugs.”

Homes that violate the rules face few consequences.

In 2019 and 2021, Medicare said it planned to conduct targeted inspections to examine the issue of false schizophrenia diagnoses, but those plans were repeatedly put on hold because of the pandemic.

In an analysis of government inspection reports, The Times found about 5,600 instances of inspectors citing nursing homes for misusing antipsychotic medications. Nursing home officials told inspectors that they were dispensing the powerful drugs to frail patients for reasons that ranged from “health maintenance” to efforts to deal with residents who were “whining” or “asking for help.”

In more than 99 percent of the cases, inspectors concluded that the violations represented only “potential,” not “actual,” harm to patients. That means the findings are unlikely to hurt the homes’ ratings.

‘He Was So Little’

Mr. Blakeney’s wife of four decades and one of his adult daughters said in interviews that he had never exhibited any mental health problems. Then he developed dementia, and his behavior became difficult to manage. His wife, Yvonne Blakeney, found that she could no longer care for him.

Over the next several months, Mr. Blakeney was in and out of medical facilities, where he was treated for problems including a urinary tract infection. He became increasingly confused and upset.

In April 2016, he went to the Lancaster Convalescent Center, a nursing home in Lancaster, S.C., where a doctor labeled him with schizophrenia on a form that authorized the use of antipsychotic drugs. That diagnosis, however, did not appear on his subsequent hospital records.

Lancaster’s administrator declined to comment.

Six months later, Mr. Blakeney arrived at Dundee Manor, a 110-bed home in Bennettsville, S.C. At the time, it received only one out of five stars in Medicare’s rating system. The low score reflected poor marks from government inspectors who had visited the facility. It was also penalized for inadequate staffing.

When Mr. Blakeney was admitted, schizophrenia did not appear in his long list of ailments, which included high blood pressure, pneumonia and advanced dementia, according to medical records disclosed in a lawsuit that his widow later filed against the home.

Two weeks after his arrival, Dundee Manor’s medical director, Dr. Stephen L. Smith, instructed the home to add the schizophrenia diagnosis so that Mr. Blakeney could continue to receive Haldol. He was also prescribed Zyprexa, as well as the sleeping pill Ambien and trazodone, which is often given to help patients sleep.

Ms. Blakeney’s lawyer, Matthew Christian, said he had not seen any evidence that anyone conducted a psychiatric evaluation of Mr. Blakeney.

Mr. Blakeney, who had worked for decades as a farmhand, was once tall and muscular. But the drugs left him confined to his bed or wheelchair, exhausted. When his wife and sister visited, they couldn’t wake him, even when they brought his favorite meal of fried chicken. Over eight months, his weight dropped from 205 to 128 pounds.

“I cried because he was so little,” Ms. Blakeney said. “You could see his rib cage, just sticking out.”

Mr. Blakeney’s medical records show that several people warned that he was too sedated and receiving too many drugs.

Three weeks after he arrived at Dundee Manor, a physical therapist noted his extreme lethargy, even when she washed his hands and face. In mid-November, after Mr. Blakeney lost 12 pounds in a single week, a dietitian left a note for the doctor. “Consider medication adjustment,” she wrote, adding that he was “sleeping all day and through meals.”

That month, an outside pharmacist filled out a form recommending that Mr. Blakeney’s doses of Haldol and Zyprexa be reduced to comply with federal guidelines that require nursing homes to gradually reduce doses of antipsychotics.

On a form with Dr. Smith’s name and signature, a box labeled “disagree” was checked. “Staff feels need” for the continued doses, the form noted.

It was exactly the sort of decision — prescribing powerful drugs to help the nursing home and its staff, not the patient — that the 1987 law was supposed to ban.

Dr. Smith declined to comment. Dundee Manor didn’t respond to requests for comment.

According to Medicare’s public database of nursing home ratings, only 7 percent of Dundee Manor’s long-term residents were getting antipsychotic drugs in the third quarter of 2018. That put the nursing home in a good light; the national average was roughly double.

But Dundee Manor’s relatively low figure was a mirage created by the large number of residents who were diagnosed with conditions like schizophrenia. In reality, The Times found, 29 percent of Dundee Manor’s residents were on antipsychotics at the time, according to unpublished Medicare data obtained through public records requests by California Advocates for Nursing Home Reform.

Five-Star Problems

False schizophrenia diagnoses are not confined to low-rated homes. In May, the inspector general of the Department of Health and Human Services, for example, identified 52 nursing homes where at least 20 percent of all residents had an unsupported diagnosis. Medicare rated more than half of those homes with at least four of the maximum five stars. (The inspector general’s report didn’t identify the nursing homes. The Times obtained their identities through a public-records request.)

One was the Hialeah Shores Nursing and Rehabilitation Center in Miami, a 106-bed home bordered by palm trees and a white painted fence. It is a five-star facility that, according to the official statistics, prescribed antipsychotics to about 10 percent of its long-term residents in 2018.

That was a severe understatement. In fact, 31 percent of Hialeah Shores residents were on antipsychotics, The Times found.

In 2018, a state inspector cited Hialeah Shores for giving a false schizophrenia diagnosis to a woman. She was so heavily dosed with antipsychotics that the inspector was unable to rouse her on three consecutive days.

There was no evidence that the woman had been experiencing the delusions common in people with schizophrenia, the inspector found. Instead, staff at the nursing home said she had been “resistive and noncooperative with care.”

Dr. Jonathan Evans, a medical director for nursing homes in Virginia who reviewed the inspector’s findings for The Times, described the woman’s fear and resistance as “classic dementia behavior.”

“This wasn’t five-star care,” said Dr. Evans, who previously was president of a group that represents medical staff in nursing homes. He said he was alarmed that the inspector had decided the violation caused only “minimal harm or potential for harm” to the patient, despite her heavy sedation. As a result, he said, “there’s nothing about this that would deter this facility from doing this again.”

Representatives of Hialeah Shores declined to comment.

Seven of the 52 homes on the inspector general’s list were owned by a large Texas company, Daybreak Venture. At four of those homes, the official rate of antipsychotic drug use for long-term residents was zero, while the actual rate was much higher, according to the Times analysis comparing official C.M.S. figures with unpublished data obtained by the California advocacy group.

More than 39 percent of residents at Daybreak’s Countryside Nursing and Rehabilitation, for example, were receiving an antipsychotic drug in 2018, even though the official figure was zero.

A lawyer for Daybreak, Charles A. Mallard, said the company could not comment because it had sold its homes and was shutting its business.

A Sprinkle of Depakote

As the U.S. government has tried to limit the use of antipsychotic drugs, nursing homes have turned to other chemical restraints.

Depakote, a medication to treat epilepsy and bipolar disorder, is one increasingly popular choice. The drug can make people drowsy and increases the risk of falls. Peer-reviewed studies have shown that it does not help with dementia, and the government has not approved it for that use.

But prescriptions of Depakote and similar anti-seizure drugs have accelerated since the government started publicly reporting nursing homes’ use of antipsychotics.

Between 2015 and 2018, the most recent data available, the use of anti-seizure drugs rose 15 percent in nursing home residents with dementia, according to an analysis of Medicare insurance claims that researchers at the University of Michigan prepared for The Times.

And while Depakote’s use rose, antipsychotic prescriptions fell 16 percent.

“The prescribing is far higher than you would expect based on the actual amount of epilepsy in the population,” said Dr. Donovan Maust, a geriatric psychiatrist at the University of Michigan who conducted the research.

About half the complaints that California Advocates for Nursing Home Reform receives about inappropriate drugging of residents involve Depakote, said Anthony Chicotel, the group’s top lawyer. It comes in a “sprinkle” form that makes it easy to slip into food undetected.

“It’s a drug that’s tailor-made to chemically restrain residents without anybody knowing,” he said.

In the early 2000s, Depakote’s manufacturer, Abbott Laboratories, began falsely pitching the drug to nursing homes as a way to sidestep the 1987 law prohibiting facilities from using drugs as “chemical restraints,” according to a federal whistle-blower lawsuit filed by a former Abbott saleswoman.

According to the lawsuit, Abbott’s representatives told pharmacists and nurses that Depakote would “fly under the radar screen” of federal regulations.

Abbott settled the lawsuit in 2012, agreeing to pay the government $1.5 billion to resolve allegations that it had improperly marketed the drugs, including to nursing homes.

Nursing homes are required to report to federal regulators how many of their patients take a wide variety of psychotropic drugs — not just antipsychotics but also anti-anxiety medications, antidepressants and sleeping pills. But homes do not have to report Depakote or similar drugs to the federal government.

“It is like an arrow pointing to that class of medications, like ‘Use us, use us!’” Dr. Maust said. “No one is keeping track of this.”

Lobbying for More

In 2019, the main lobbying group for for-profit nursing homes, the American Health Care Association, published a brochure titled “Nursing Homes: Times have changed.”

“Nursing homes have replaced restraints and antipsychotic medications with robust activity programs, religious services, social workers and resident councils so that residents can be mentally, physically and socially engaged,” the colorful two-page leaflet boasted.

Last year, though, the industry teamed up with drug companies and others to push Congress and federal regulators to broaden the list of conditions under which antipsychotics don’t need to be publicly disclosed.

“There is specific and compelling evidence that psychotropics are underutilized in treating dementia and it is time for C.M.S. to re-evaluate its regulations,” wrote Jim Scott, the chairman of the Alliance for Aging Research, which is coordinating the campaign.

The lobbying was financed by drug companies including Avanir Pharmaceuticals and Acadia Pharmaceuticals. Both have tried — and so far failed — to get their drugs approved for treating patients with dementia. (In 2019, Avanir agreed to pay $108 million to settle charges that it had inappropriately marketed its drug for use in dementia patients in nursing homes.)

‘Hold His Haldol’

Ms. Blakeney said that only after hiring a lawyer to sue Dundee Manor for her husband’s death did she learn he had been on Haldol and other powerful drugs. (Dundee Manor has denied Ms. Blakeney’s claims in court filings.)

During her visits, though, Ms. Blakeney noticed that many residents were sleeping most of the time. A pair of women, in particular, always caught her attention. “There were two of them, laying in the same room, like they were dead,” she said.

In his first few months at Dundee Manor, Mr. Blakeney was in and out of the hospital, for bedsores, pneumonia and dehydration. During one hospital visit in December, a doctor noted that Mr. Blakeney was unable to communicate and could no longer walk.

“Hold the patient’s Ambien, trazodone and Zyprexa because of his mental status changes,” the doctor wrote. “Hold his Haldol.”

Mr. Blakeney continued to be prescribed the drugs after he returned to Dundee Manor. By April 2017, the bedsore on his right heel — a result, in part, of his rarely getting out of bed or his wheelchair — required the foot to be amputated.

/In June, after weeks of fruitless searching for another nursing home, Ms. Blakeney found one and transferred him there. Later that month, he died.

“I tried to get him out — I tried and tried and tried,” his wife said. “But when I did get him out, it was too late.”

Maine Nursing Home Offered Bonuses For Workers Who Don’t Publicly Criticize

by Caitlin Andrews - BDN/Maine Public - September 12, 2021

A Deer Isle nursing home is requiring employees to not disparage the home if they want retention bonuses ahead of a planned late-October closure and rejected strategies from the state on ways to stay open.

The Island Nursing Home was the first of three facilities to announce they would be closing by the end of October after the COVID-19 pandemic put additional strain on a workforce that has long struggled with low wages and staff retention. The abrupt closing rocked and upset a remote community reliant on it as one of just three remaining nursing homes in Hancock County.

The facility has been quiet since it announced its closing on Aug. 30, roughly two months before its expected closure. But the home is going to great lengths to convince employees to stay on ahead of the departure of contract staff that will require the home to immediately discharge residents, showing how dire the staffing challenges are in Maine, something industry experts fear could worsen as the pandemic continues.

Island Nursing Home board President Ronda Dodge said Wednesday on an Island Health and Wellness Foundation podcast the facility is expected to lose 13 contract staff by Sept. 22. That will leave the home with 780 hours, or 20 full-time employee positions, unfilled, requiring the 50 percent of residents be discharged if slots are not filled. State rules require one direct care provider for every five residents during the day and one per every 15 patients on the night shift.

“Does that mean that the patients are all at risk? No,” Dodge said, adding the sudden loss of staff would trigger an emergency closing status allowing the facility to more quickly place residents still in the home. Dodge also said some have refused placement, saying they do not believe the home is closing.

The home has cited long-standing challenges in attracting staff and finding housing for them, causing it to rely on contract workers. The community has since tried to rally around the home, with local lawmakers calling for a solution and residents uncertain about where loved ones may end up.

It was one of 96 long-term care facilities to get an award for homes documenting pandemic losses, according to Maine Department of Health and Human Services spokesperson Jackie Farwell, but it is unclear what the home received.

The department met with nursing home leadership to discuss ways to prevent closing, such as working with families to transfer patients to other facilities or allow the residential population to decline, Farwell said. Dodge said on Friday the home would not be able to meet staffing requirements even with a reduction in patient levels.

Employees that do wish to stay were offered a voluntary retention award agreement guaranteeing up to eight hours of additional pay if they work 40 hours a week, although they lose the benefit if they have unscheduled absences, are fired or quit. It requires signees to agree to not make any “defamatory or derogatory statements” on social media or other outlets about management and staff, the closing itself or the operations of the facility.

Signees waive their right to a jury trial for any litigation coming from the signing of the agreement, and the home said it would stop providing the benefit and may sue any employees who break the non-disparagement clause.

Facilities usually offer retention bonuses to higher-paid staff to keep them on, said David Webbert, an employment lawyer and managing partner at the firm Johnson, Webbert & Garvan, who said it was unusual for them to be offered to rank-and-file staff. He said the agreement should be modified to include a good-faith criticism clause, otherwise workers could be discouraged from coming forward for fear of retribution.

“Things can happen between now and [the closing],” he said. “The non-disparagement agreement does not take into account the importance of employees offering feedback.”

Dodge pushed back, saying it is meant to discourage “unnecessary, inaccurate and uninformed discussion on social media and elsewhere that neither serves nor protects the interests of the residents, families and staff.” She said language allowing employees to participate in legal investigations and court cases is meant to encompass whistleblowing.

An Island Nursing Home staffer, who agreed to speak to the Bangor Daily News on the condition of anonymity, said the agreement made them “uncomfortable” and worried they would be held liable after speaking openly about the closing home. They said they were “blindsided” by the closing after management told them two days prior the facility would remain open.

“We knew staffing was bad,” she said. “But they never mentioned we might have to close because of it.”

No comments:

Post a Comment